Packaging Automation Market Expands: $2.4 Billion Growth Driven by E-commerce and Labor Challenges

Market Growth Projections

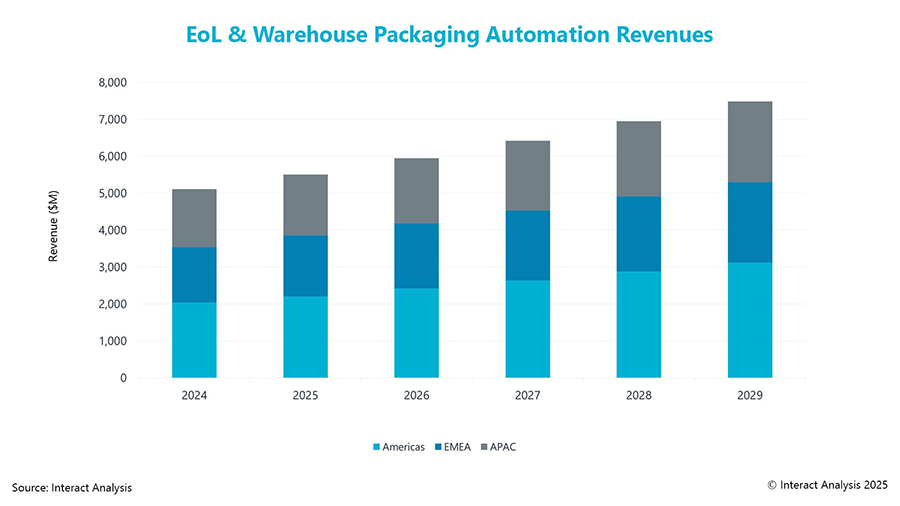

The global packaging automation market shows strong expansion potential. Interact Analysis forecasts 7.9% CAGR from 2024 to 2029. Market value will increase from $5.1 billion to $7.5 billion. The Americas region leads this significant growth trend.

Regional Investment Patterns

American and European companies prioritize warehouse automation investments. They aim to counter rising labor costs and regulatory pressures. Meanwhile, APAC growth stems from general manufacturing expansion. Each region follows distinct automation adoption drivers.

Manufacturing vs Warehouse Applications

Manufacturing packaging automation dominated 2024 revenues at 61%. This includes case packers, sealers, and erectors. However, warehouse automation shows faster growth rates. The sector benefits from e-commerce demands and waste reduction legislation.

Emerging Technology Adoption

Right-fit boxers and bagging machines experience rapid adoption. Robotic palletizing solutions also gain significant traction. Amazon drives expectations across European facilities. These technologies optimize packaging materials and reduce costs.

Expert Analysis and Insights

“Amazon supercharged automatic right-fit boxer expectations,” stated Vanessa Lopez. “Warehousing offers greater growth opportunities than manufacturing. Many packaging processes remain manual in distribution centers.” This analysis comes from extensive market research.

Industrial Automation Integration

Packaging automation integrates with PLC and DCS control systems. Modern solutions feature advanced sensors and robotics. Furthermore, they connect with factory automation networks. This creates seamless production-to-warehouse material flow.

Implementation Considerations

✅ Right-fit boxers reduce material waste by 20-30%

⚙️ Robotic palletizers handle diverse product sizes

🔧 Case erectors support high-volume production lines

Proper system integration ensures maximum efficiency gains.

Market Opportunity Analysis

Warehouse packaging represents the fastest-growing segment. Manufacturing applications maintain larger market share. However, automation penetration varies significantly by region. Companies should evaluate their specific operational requirements.

World of PLC Industry Perspective

This growth reflects broader industrial automation trends. Packaging lines increasingly require sophisticated control systems. Moreover, integration between manufacturing and warehousing becomes crucial. Companies should consider scalable automation solutions.

For packaging automation control systems and integration solutions, visit World of PLC’s comprehensive product portfolio featuring industrial automation components from leading manufacturers.

Implementation Strategy Recommendations

Start with automated case erectors and sealers for quick ROI. Then integrate right-fit boxers for e-commerce applications. Finally, implement robotic palletizing for complete line automation. This phased approach minimizes disruption and maximizes returns.

Frequently Asked Questions

What drives packaging automation adoption?

Labor costs, e-commerce demands, and sustainability regulations primarily drive adoption. Companies seek efficiency improvements and cost reductions.

Which applications show strongest growth?

Right-fit boxers and robotic palletizing demonstrate exceptional growth rates. These technologies address specific e-commerce and labor challenges.

How does packaging automation integrate with existing systems?

Modern packaging systems connect through industrial networks and protocols. They interface with PLCs, DCS, and warehouse management systems seamlessly.