Electronic System Design Industry Surges to $5.1 Billion in Q2 2025

ESD Alliance Reports Electronic System Design Industry Posts $5.1 Billion in Revenue in Q2 2025

Steady Growth in Electronic System Design Revenue

The global Electronic System Design (ESD) market continues its upward trend, achieving $5.1 billion in revenue in Q2 2025. This marks an 8.6% year-over-year increase from $4.68 billion in Q2 2024, according to the Electronic Design Market Data (EDMD) report by the SEMI Technology Community.

Moreover, the four-quarter moving average rose 10.4%, confirming consistent growth in the industrial automation and semiconductor design sectors.

Key Product Segments Driving Growth

Revenue growth was primarily led by strong performance in Computer-Aided Engineering (CAE) and Semiconductor IP (SIP).

- CAE revenue surged 17.2% to $1.93 billion, reflecting increased adoption in control systems and factory automation applications.

- SIP revenue rose 8.7% to $1.83 billion, supported by demand for high-performance embedded chips used in PLC and DCS architectures.

- PCB and MCM categories also grew by 7.8% to $430.5 million, emphasizing the role of compact board design in modern industrial electronics.

- Services expanded 11.9% to $201.2 million, showing the growing need for integration and system support.

However, IC Physical Design and Verification revenue declined by 9.9% to $701.9 million, suggesting that advanced chip layout optimization tools are nearing market saturation.

Regional Insights: Americas and EMEA Lead Expansion

Geographically, all major regions demonstrated resilience in Q2 2025.

- The Americas generated $2.28 billion in revenue, marking a strong 12.2% growth, driven by semiconductor R&D and industrial automation modernization projects.

- EMEA followed with an 11.4% increase, emphasizing investments in smart manufacturing and sustainability-driven design.

- APAC maintained stability with $1.88 billion, up 6.7%, supported by strong electronics exports and control system integration initiatives.

- Japan faced a 9.2% decline, reflecting its slower transition toward next-generation semiconductor design platforms.

As a result, the overall EDA ecosystem continues to support the digital transformation of manufacturing and automation industries worldwide.

Workforce and Industry Momentum

The report also highlights a growing workforce, with 72,529 professionals employed globally in Q2 2025 — up 14.8% from the previous year.

This increase reflects expanding R&D operations and rising demand for skilled engineers in automation software, embedded design, and system verification.

According to MarketsandMarkets, the global EDA and automation design market is projected to reach $16 billion by 2028, supporting further integration between hardware and industrial control systems.

Expert Analysis from World of PLC

According to World of PLC, these results confirm that industrial automation and semiconductor design are increasingly interlinked.

As control systems evolve, demand for miniaturized components and EDA software capable of handling complex architectures will rise.

In addition, companies leveraging digital twins and AI-driven design validation are expected to gain competitive advantages in both performance and time-to-market.

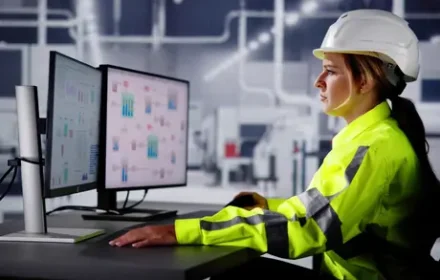

Practical Application: From Design to Factory Automation

Manufacturers integrating Electronic System Design tools with PLC-based automation can enhance system reliability and optimize production.

For instance, implementing EDA-driven simulation in DCS environments allows engineers to predict system performance before deployment.

This proactive approach reduces downtime, improves energy efficiency, and ensures consistent product quality across production lines.

To explore advanced industrial automation products and PLC solutions, visit

World of PLC Limited.

Frequently Asked Questions (FAQ)

1. What drives growth in the Electronic System Design industry?

Increased semiconductor complexity, factory automation expansion, and AI-driven chip design tools are key growth factors.

2. How does ESD impact industrial automation?

ESD technologies enable faster product development, improving system reliability in PLCs, DCS, and embedded control systems.

3. Which regions show the most potential for future growth?

The Americas and EMEA currently lead, but APAC’s investment in smart factories will accelerate growth in coming years.

Conclusion: Designing the Future of Automation

The ESD industry’s growth demonstrates its vital role in shaping the future of industrial automation.

With strong performance across CAE, SIP, and PCB sectors, the market is poised to support global transitions toward intelligent, efficient, and secure manufacturing systems.